Business environment

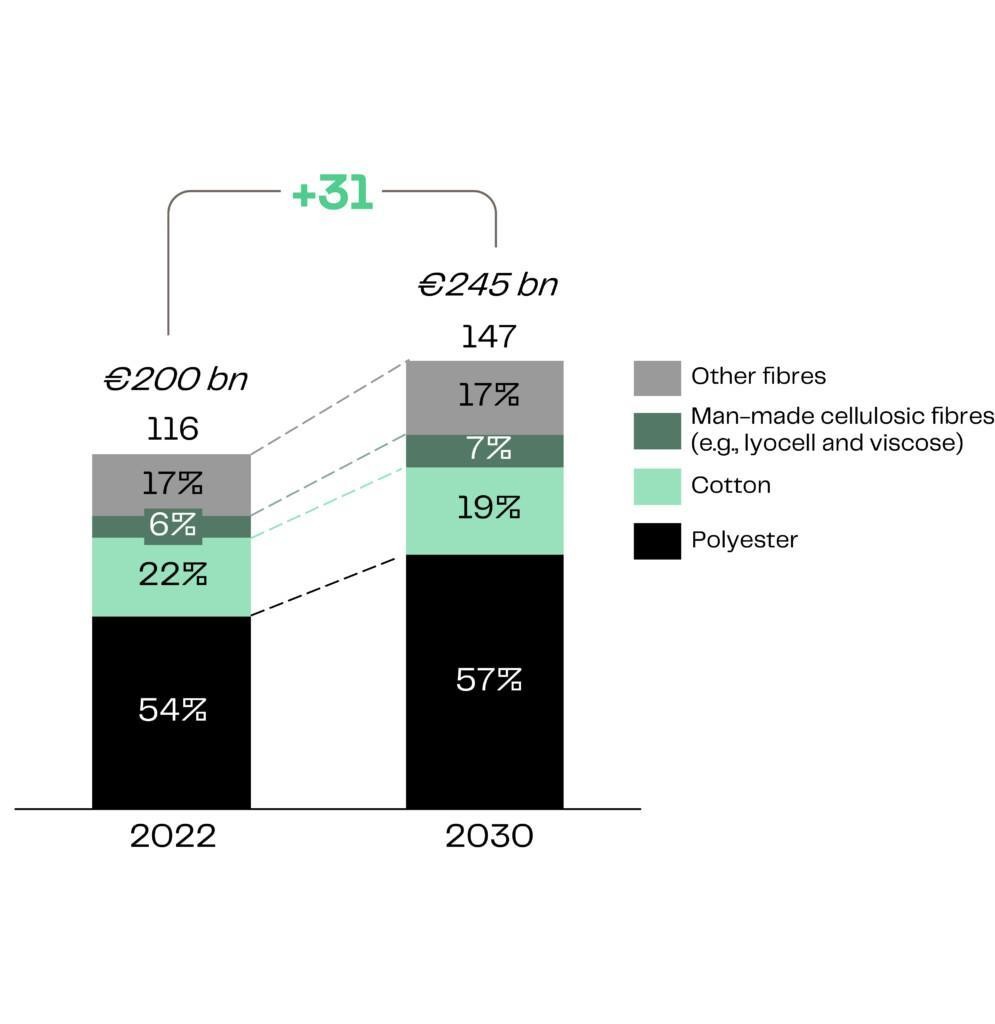

116 million tonnes of textile fibres were produced in 2022, and the production is estimated to grow to approximately 147 million tonnes by 2030. The value of the textile fibre market is about EUR 200 billion as of 2022 and is expected to grow to approximately EUR 245 billion by 2030.

The fashion and apparel industry accounts for 4% of global greenhouse gas (GHG) emissions

Fashion and apparel represent approximately 75 to 85% of the global fibre market.2 The number of units sold in 2019 accounts for approximately 90 million tons of fibre, a market value of approximately EUR 160 billion. 3

The recent increase in apparel consumption is driven by several factors, most importantly the growing middle class contributing to higher consumption, shorter fashion trends and fewer usage times of apparels before disposal. 4

The fashion and apparel industry accounts for 4 per cent of global greenhouse gas (GHG) emissions, where material production stands for approximately 49% of the GHG emissions.5 The industry consumes billions of litres of water and is estimated to create more than 90 million tonnes of waste annually.6 A large share of major fashion and apparel brands have made commitments to significantly improve their environmental footprint.7

The textile fibre market needs natural fibre alternatives

Fibre types and fibre mix

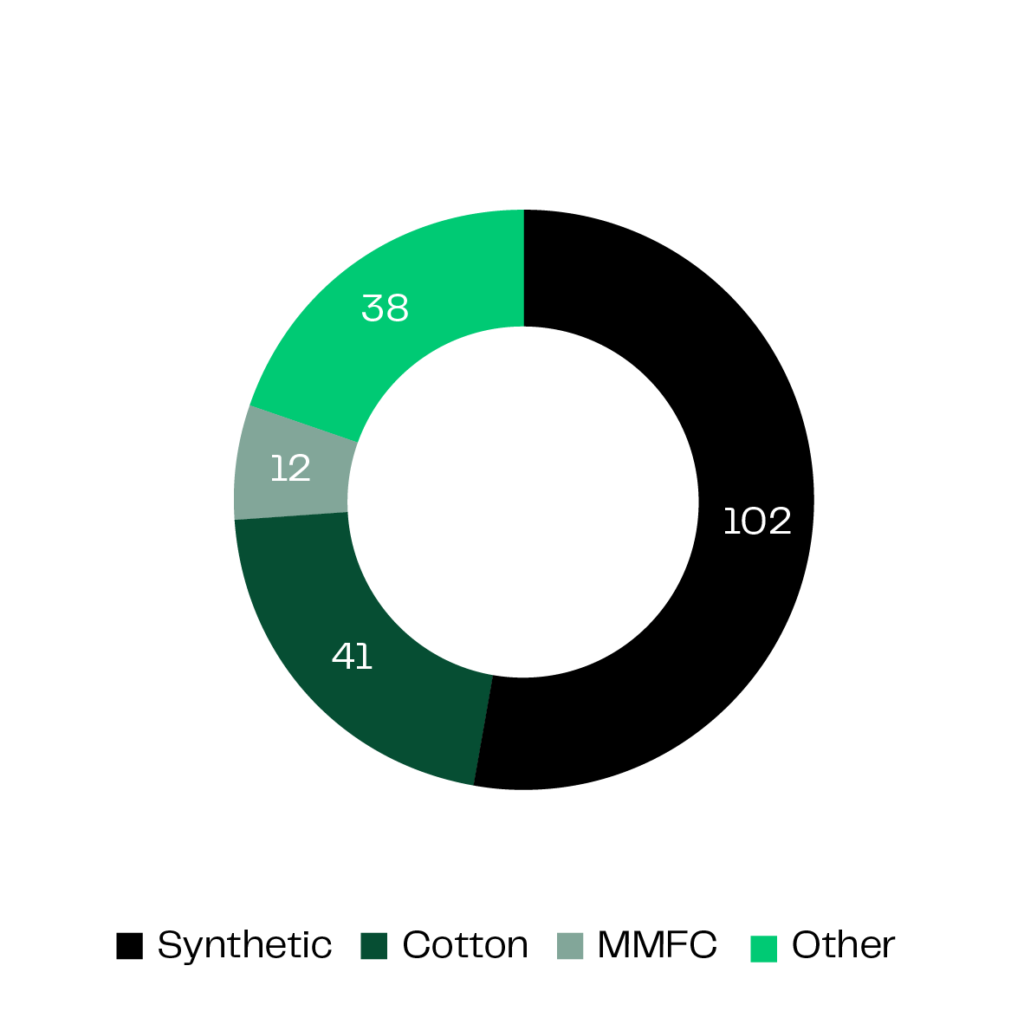

The global fibre market consists of several fibre types, which can be divided into natural fibres, man-made cellulosic fibres (MMCF) and synthetic fibres (petroleum based). Natural fibres include plant-based fibres such as cotton and linen, animal-based fibres such as wool and silk and mineral based fibres such as glass fibre.

Man-made cellulosic fibres can include chemically regenerated fibres, such as viscose, acetate, carbamate, lyocell, fibres produced with ionic liquids and cupro. Synthetic fibres include fibres that are produced from petroleum such as polyester, acrylic and elastane. Synthetic fibres represent the largest part of the global fibre market.

A shortage of natural-based fibres

As the global apparel market is growing, there is an increasing demand for fibre production. However, according to current estimates the forecasted supply of fibres will not be able to meet the fibre demand. Firstly, only 60-70 per cent of global fibre supply can be synthetic due to the limits of its applications and properties. Secondly, global cotton production has slowed down due to the shortage of cultivable land and decreased availability of water. Thirdly, other natural fibres, such as animal and plant-based fibres, have limited applications and scalability. These factors are expected to form a shortage in natural fibre production.9

3+ million tonnes of new man-made cellulosic fibre capacity needed (2022-2030)

Significant production investments are needed on global basis to satisfy the demand growth of millions of tonnes of textile fibres. Supply constraints in natural fibres will drive demand for alternative fibres with a natural feel, also opening opportunities for new sustainable fibres, such as Spinnova.

The only other fibres that could meet the capacity requirements are synthetic fibres, which are based on fossil petroleum. Synthetic fibres lack certain properties, which make them inadequate substitutes for natural fibres. In addition, synthetic fibres have been severely criticised due to their negative environmental impacts.10

Spinnova’s target market

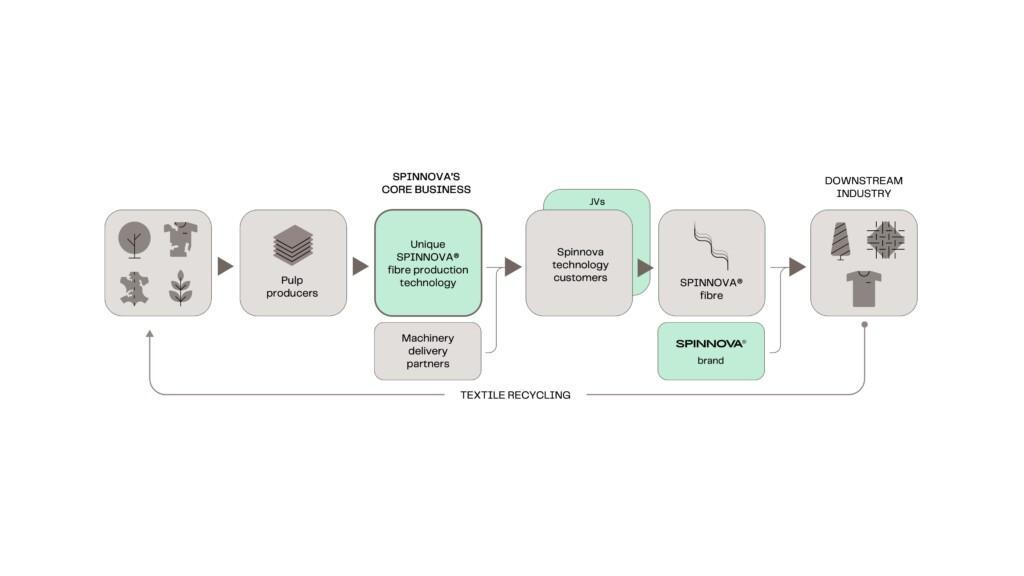

SPINNOVA® fibre is suitable for multiple applications and industries. Spinnova is first focusing on the apparel industry because of SPINNOVA® fibre’s cotton-like qualities and the apparel industry’s high demand for sustainable materials.

Spinnova offers a scalable solution for the natural fibre gap

Spinnova’s position in the value chain

Spinnova operates in the apparel industry value chain, which starts from raw materials followed by many subsequent steps in order to produce the final products that reach customers. At the beginning of the value chain is the production of textile fibre. The ways in which fibre is produced varies according to the type of fibre, whether natural or synthetic. The fibre is spun into yarn, which is then weaved or knitted into fabric. Fabric can then be used to create apparel that is sold to consumers. Yarn and fabric makers as well as apparel makers typically work as contractors for the apparel brands which hold the highest level of power in the value chain.

Spinnova’s competitive position

Based on the Spinnova’s understanding, Spinnova is one of the first companies in the world that is able to produce the most natural man-made fibre, commercially manufactured from wood pulp using mechanical processes only and without chemically modifying the fibres. Thus, Spinnova believes that it has an excellent market position as both customers and apparel companies are favouring environmentally friendly solutions for the manufacturing of garment and looking for sustainable options that meet the capacity requirements.

Many other fibre producers use natural-based feedstock, but their chemical or dissolving processes change the chemical structure of the feedstock, resulting in man-made fibres, which can be classified as even plastic in certain products.

There are also other mechanical processes that use no harmful chemicals, but these technologies and fibres require synthetic, oil-based materials or they are limited to smaller scale (e.g. cotton mechanical recycling).

1 Source: Textile Exchange, Sustainable Raw Materials Will Drive Profitability for Fashion and Apparel Brands (2023), The State of Fashion 2024

2 Source: Ellen McArthur foundation, A new textiles economy: Redesigning fashion’s future, 2017, available at http://www.ellenmacarthurfoundation.org/publications; Circular Fibres Initiative analysis based on Euromonitor database, International Apparel & Footwear, 2016 Edition (volume sales trends 2005–2015); Euromonitor database, Retail market for Apparel & Footwear, 2019; World Bank database, World GDP 2000-2020; Ellen MacArthur Foundation, A new textiles economy: Redesigning fashion’s future, 2017, available at http://www.ellenmacarthurfoundation.org/publications.

3 Source: The Fiber Year 2019, 2020, https://www.thefiberyear.com/fileadmin/pdf/TOC2019.pdf; Textile Exchange, Preferred Fiber & Materials Market Report 2020, https://textileexchange.org/wp-content/uploads/2020/06/Textile-Exchange_Preferred-Fiber-Material-Market-Report_2020.pdf; OECD-FAO Agricultural Outlook report, OECD/FAO, 2020, https://www.oecd-ilibrary.org/agriculture-and-food/oecd-fao-agricultural-outlook-2019-2028_a4b3631d-en#:~:text=Cotton%20production%20is%20sensitive%20to,countries%20in%20the%20past%20decade; Euromonitor database, Retail market value for home textile and apparel, 2019 retrieved 2021, https://www.euromonitor.com/; ICAC World textile demand Global Textile Fibre Demand: Trends and Forecast, Retail market value for home textile and apparel, 2019; Fastmarkets RISI database, DWP & softwood price 13 April 2021, https://www.risiinfo.com/service/mill-data-costs/asset-database/; The Freedonia Group, Global non wovens market report, 2019, https://www.freedoniagroup.com/industry-study/global-nonwovens-3693.htm.

4 Source: Ellen McArthur foundation, A new textiles economy: Redesigning fashion’s future, 2017, available at http://www.ellenmacarthurfoundation.org/publications; Circular Fibres Initiative analysis based on Euromonitor database, International Apparel & Footwear, 2016 Edition (volume sales trends 2005–2015); Euromonitor database, Retail market for Apparel & Footwear, 2019; World Bank database, World GDP 2000-2020; Ellen MacArthur Foundation, A new textiles economy: Redesigning fashion’s future, 2017, available at http://www.ellenmacarthurfoundation.org/publications.

5 Fashion on Climate, McKinsey & Global Fashion Agenda, August 2020.

6 Niinimäki, K., Peters, G., Dahlbo, H. et al. The environmental price of fast fashion. Nat Rev Earth Environ 1, 189–200 (2020). https://doi.org/10.1038/s43017-020-0039-9.

7 Science-based Targets Initiative data retrieved April 2021, sector filtered: “Textiles, Apparel”

8 Other including silk, wool, down, and plant-based fibres, e.g. as jute, linen and hemp. Source: The Fiber Year 2019, 2020, https://www.thefiberyear.com/fileadmin/pdf/TOC2019.pdf; Textile Exchange, Preferred Fiber & Materials Market Report 2020, https://textileexchange.org/wp-content/uploads/2020/06/Textile-Exchange_Preferred-Fiber-Material-Market-Report_2020.pdf; OECD-FAO Agricultural Outlook report, OECD/FAO, 2020, https://www.oecd-ilibrary.org/agriculture-and-food/oecd-fao-agricultural-outlook-2019-2028_a4b3631d-en#:~:text=Cotton%20production%20is%20sensitive%20to,countries%20in%20the%20past%20decade; Euromonitor database, Retail market value for home textile and apparel, 2019 retrieved 2021, https://www.euromonitor.com/; ICAC World textile demand Global Textile Fibre Demand: Trends and Forecast, Retail market value for home textile and apparel, 2019; Fastmarkets RISI database, DWP & softwood price 13 April 2021, https://www.risiinfo.com/service/mill-data-costs/asset-database/; The Freedonia Group, Global non wovens market report, 2019, https://www.freedoniagroup.com/industry-study/global-nonwovens-3693.htm.

9 Haemmerle, Franz. (2011). The Cellulose Gap (The Future of Cellulose Fiber). Lenzinger Berichte. 89.

10 Haemmerle, Franz. (2011). The Cellulose Gap (The Future of Cellulose Fiber). Lenzinger Berichte. 89.